Upon taking over of the Studio System Flagship offering, the product offering was a legacy workflow tool used for basic lookup of entertainment industry People, Company, and Project information. Over the course of two years we were able to reinforce the Studio System as the industry standard for entertainment data and business intelligence, serving every major Studio, Television Network, Talent Agency and Production company as their go to resource for competitive analysis.

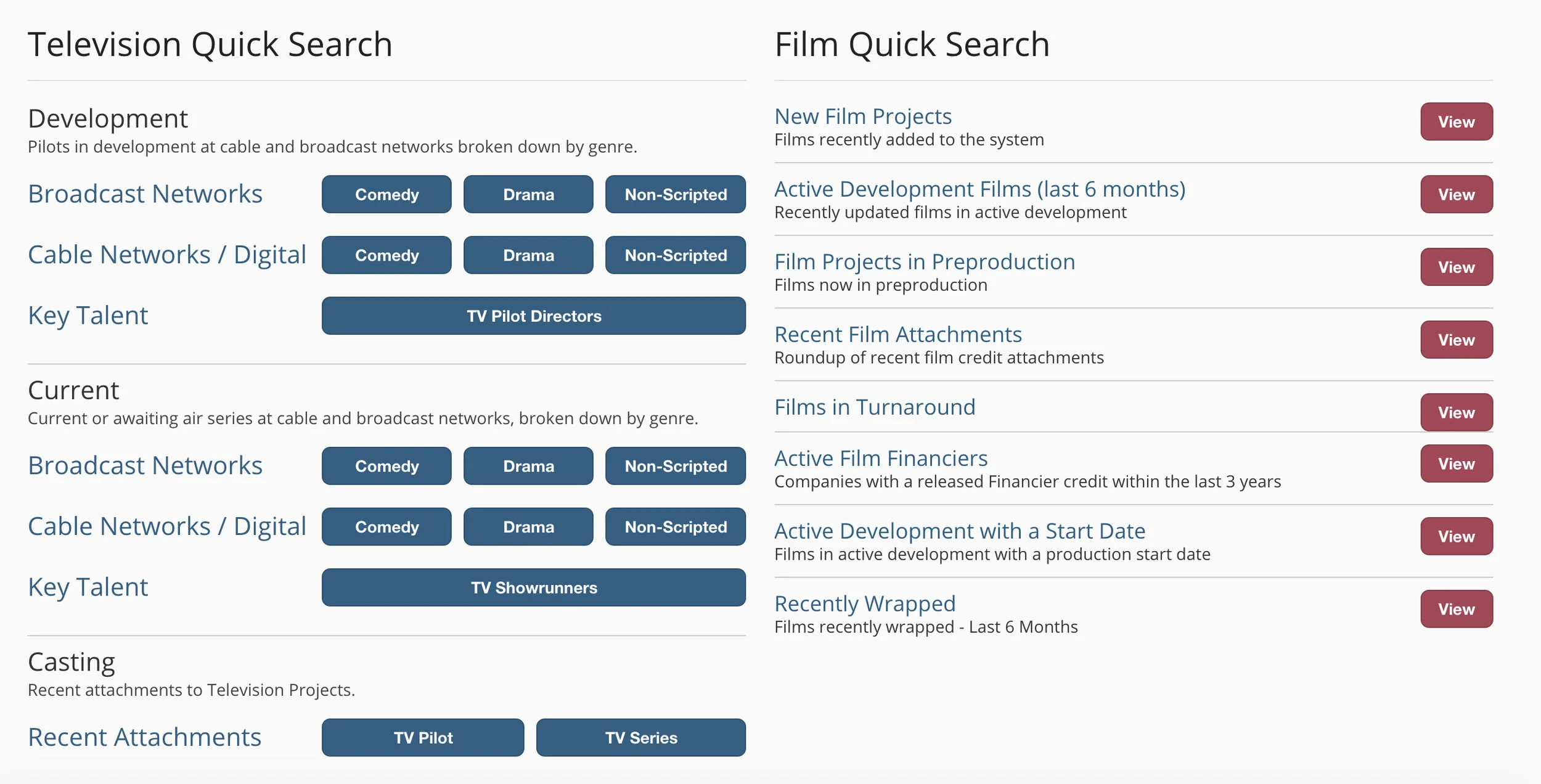

One Click Competitive Intelligence Lists

The Studio System, being a robust data set dating back to the early 1900's provided powerful list creation and export tools that typically were subject to use by power users representing only 5% of the active subscriber base. Here we redeveloped the top level customized user homepage within the core application and pulled the most valuable lists from our advanced analysis engine and created portable single click lists to bring the functionality to the entire user base.

Featured Tools

Overall Deals

The overall deals report was a legacy list that was managed on a quarterly basis and sold as an ala carte solution to various production companies and agencies. This list was normalized and integrated into our internal mapping solution to ingest into our relational person and company database. As deals are constantly changing within the industry this is a hyper critical data set for users to analyze current content or production deals to navigate project development which is now globally available as a value add.

Festival Calendars

Baseline tracks every film in competition from Sundance to Berlin to fringe festivals of note. Here we compiled a tool to see a historic nomination and award winners snapshot on an annual basis across multiple festivals or a historic reference tool on an individual basis. There was heavy use here by film financiers to gain early insight into competition films and their related sales agents to get a jump on any bidding wars for project acquisitions as well as to validate all parties involved based on previous performance.

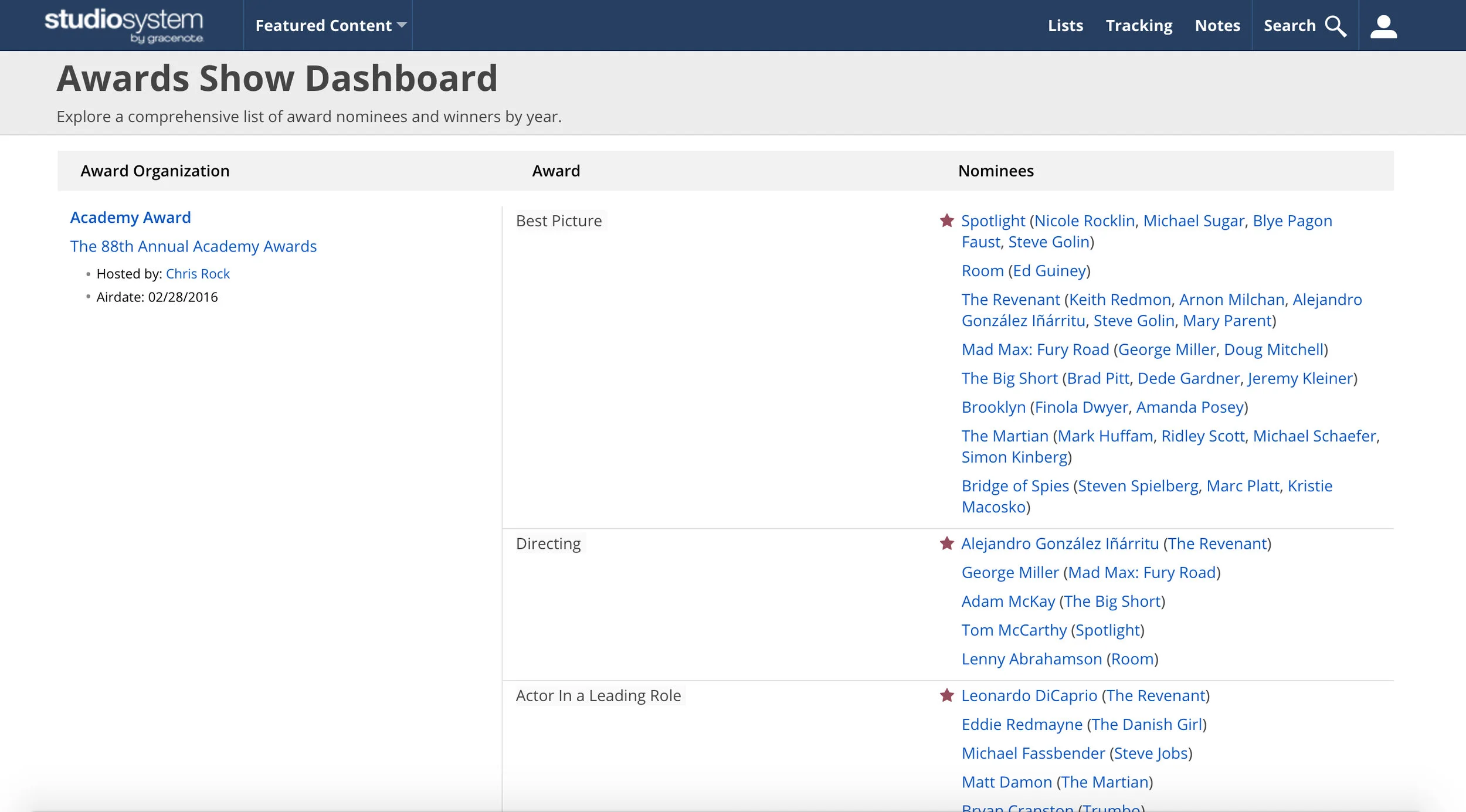

Awards Dashboard and Analytics

Along with festival tracking, Baseline is also the go to source for historic awards information. Here users receive a breakdown again on an annual cross awards basis to see a summary of the years winners and nominees at major awards presentations. Layered on top of winner and nominee reporting we integrated personal and project level detail to quantify the impact of awards on metrics such as box office performance domestically and internationally or on a per actor, director, and writer basis. We even went so far as creating historical analysis to attempt to predict Academy Awards winners based on historical data around nominations and wins at smaller awards shows, our first algorithm held an 85% accuracy rate at year of launch.

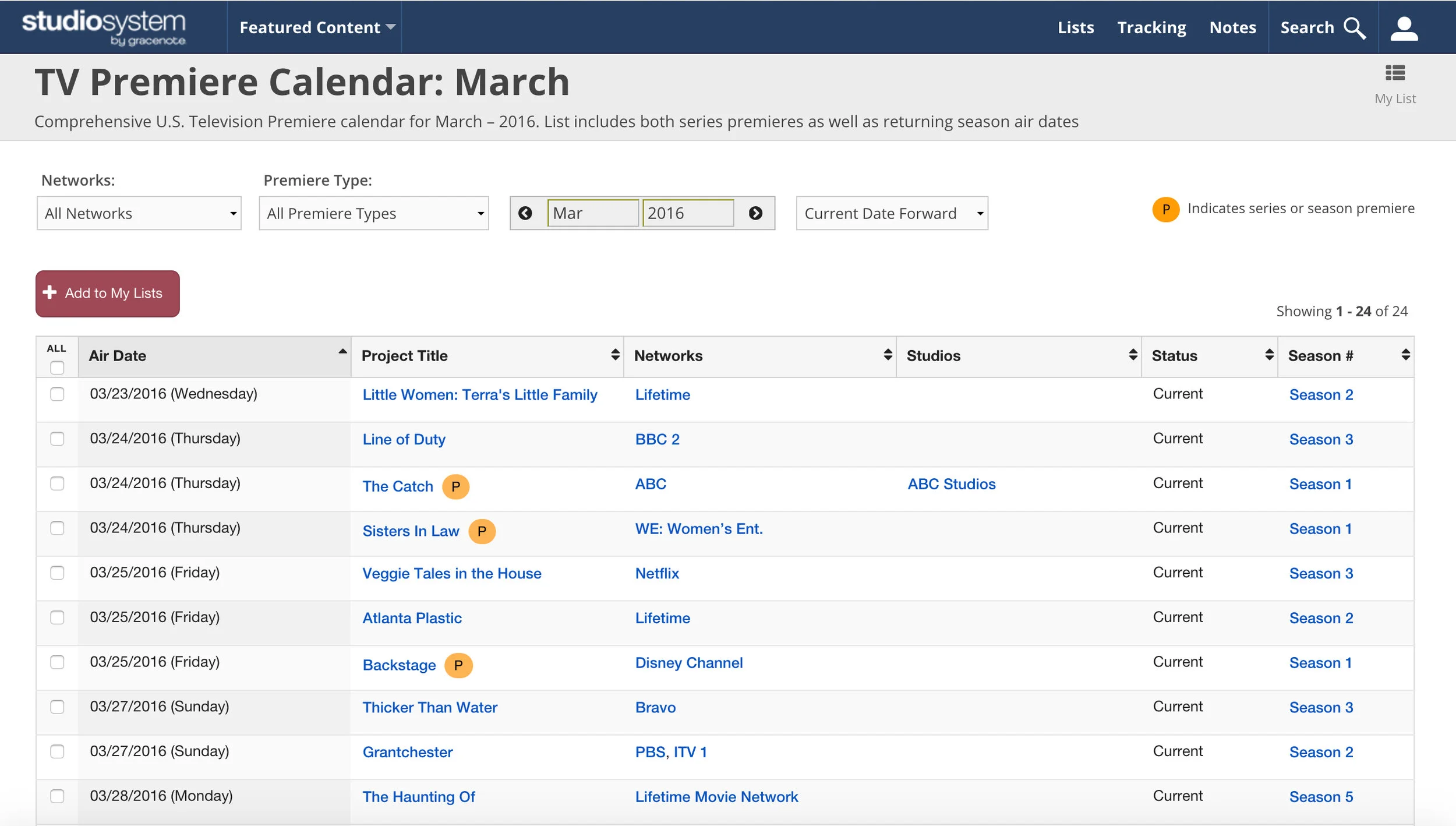

TV Premiere Calendar / Listings

Via a syndication deal Baseline as a company branched into tracking on an individual episode level, every aired instance of a program at major broadcast and cable networks. This tool provides a visual layer to Nielson reporting data with users able to run analysis on past show performance based on date of premier or rerun.

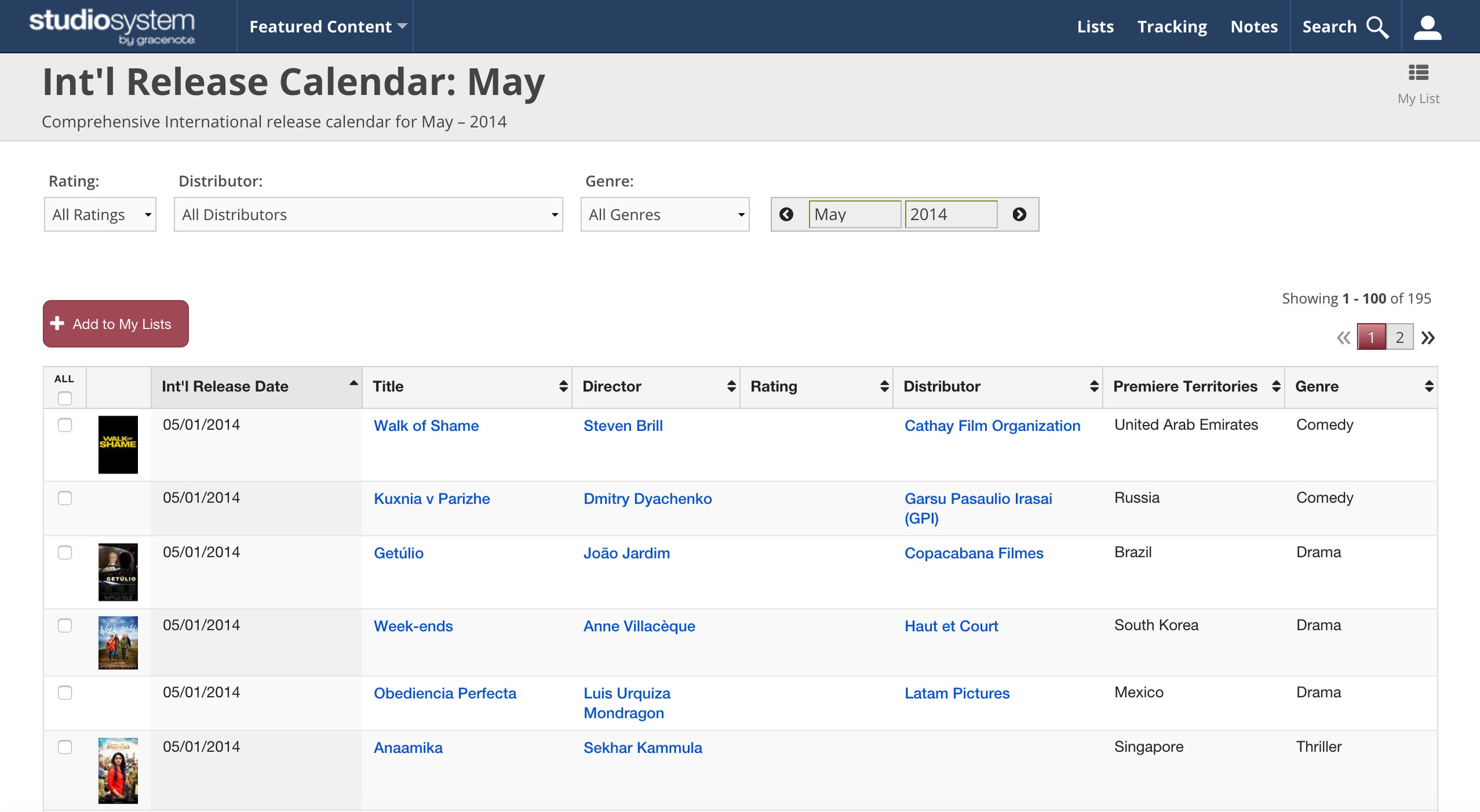

US Film and International Release Calendar

We tracked release dates for Domestic and International Theatrical premieres by Territory on an individual project level as well as key dates such as VOD and DVD premieres but didn't have a solution to see a calendarized view of that data on a monthly or even daily level. This information became the go to source for studio executives or producers to strategize around future release planning as well as have the foresight of trends in projects releasing over time.

Project Competitive Intelligence Lists

The Studio System's clients are split 50/50 by those in the Television and Film Industry. As each segment of the industry is unique with it's own intricacies, calendar, and not much overlap we invested in functional tools for each segmented group.

Television

Development

The television pilot season traditionally was a chaotic stretch that ran between January and April. With new digital players in the space that season is now effectively year round. Here television executives have access to the most up to date pilot information for both Broadcast, Cable, and Digital distribution as well as a targeted list of active directors tied to upcoming pilots.

- Pilots - Broadcast

- Pilots – Cable Networks / Digital

- Pilots – TV Pilot Directors

Current Programming

The current programming lists feature active television series and made for television projects along with talent and company associations along with performance metrics.

- Series - Broadcast

- Series – Cable Networks / Digital

- Series – Key Talent

Casting

Casting lists provide a running list of top line casting associations with pilots or Series on the season or episodic level. This list is not only important to see relative availability of actors but also used by guilds such as SAG to regulate and validate membership and fees.

- TV Pilots

- TV Series

Film Lists:

The below film lists allows studio executives or film producers the ability to pull lists of projects or related companies to then slice the data into competitive intellicence. Here use cases are the ability to answer questions such as, how may horror films are in preproduction at Sony under 50 million dollars? How many romcoms are in active development and set to shoot in los angeles?

- New Film Projects

- Active Development Films (Last 6 Months)

- Film Projects in Preproduction

- Recent Film Attachments

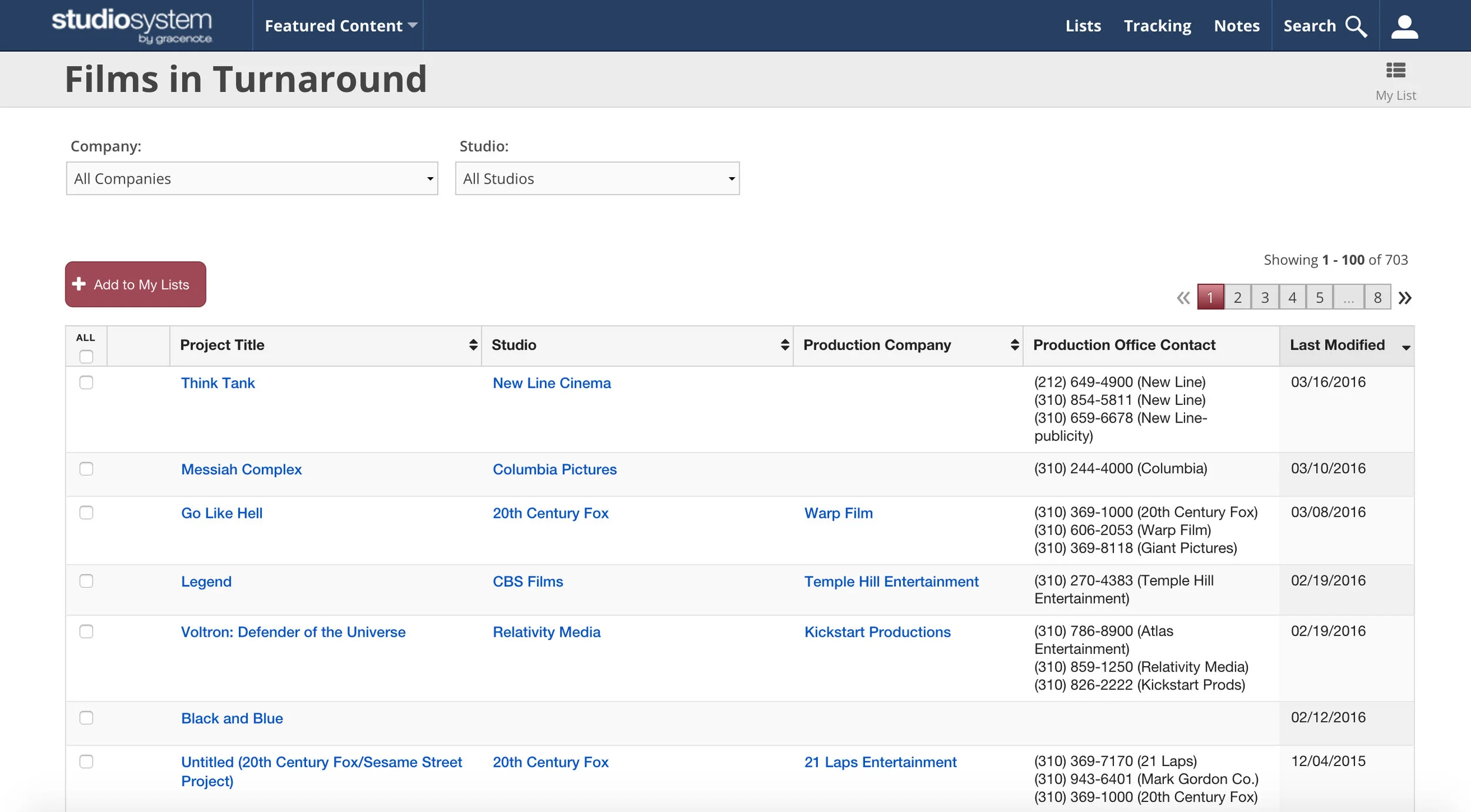

- Films in Turnaround

- Active Film Financiers

- Active Films with a Start Date

- Recently Wrapped

Industry Tracking

With an ever changing landscape of who is employed where as well as who represents who, Baseline is the industry standard on up to date industry employment or representation information. Historically we availed representation information only on individual agent pages as well as in the summary section of their represented talent. Here we showcase a ticker of movement to keep up to date with where someone was and where are they now. No more embarrassing calls of calling an actors old agent after they have already moved on.

- Recent Exec Updates

- Recent Rep Updates

Advanced Financial Analytics

The area of advanced analytics around financial reporting to me was the largest leap and bound of platform value. Here we pulled together legacy stand alone product offerings traditionally delivered ala carte by our Research and international box office division Screenline into the Studio System application for data modeling.

FRCE

Film Revenue Cost Estimate (FRCE) were a stand along offering that we ingested into the Studio System to allow independent producers the ability to create business plan project analysis on the fly. The reports offered detailed financial information on thousands of movie titles and provided specific project or a comparison of multiple projects. Statistics such as include negative cost, P&A, theatrical, home video and television revenue and ROI were leveraged to allow users to perform such tasks as quantifying a development projects potential financial range based on historic performance in a like genre or with like talent. For instance if you're looking to create a soccer romantic comedy for $20 million dollars you can pull like projects based on attachment and genre keywords to validate that your potential return on investment has a low of 80% and an upper bound of 200% based on the strength of Bend it Like Beckham and Goal. Not only was box office receipts covered here but also pay and basic cable, VOD and broadcast and syndication statistics. These services traditionally cost producers thousands of dollars to which we were able to deliver as a value add in a matter of minutes fully automated.

International Box Office

Another powerful analytics tool was the ingestion of territory by territory international box office which was acquired by proprietary IP we created as part of our internal tools platform. Again this data was traditionally sold on an ala carte basis and ingested into our centralized database to graph performance data against related talent, by genre, as well as by company. Here we were able to serve to customers reports such as who are the top actors in Argentina in the last 5 years? What genres perform the best in Japan v. Mexico? The list goes on and on in the ability to segment performance data for a multitude of uses.

Multimedia

Through data partnerships with the Everett Collection and IVA we were able to map project and person level multimedia to enrich the Studio System experience. This allowed for product expansion into the marketing and casting space as related visual information is critical in those job functions. Need a headshot or historic stills for a potential casting call and pairing that against an actors historic box office or TV performance, all was now capable in the system.

- Headshots

- Film Posters

- Trailers

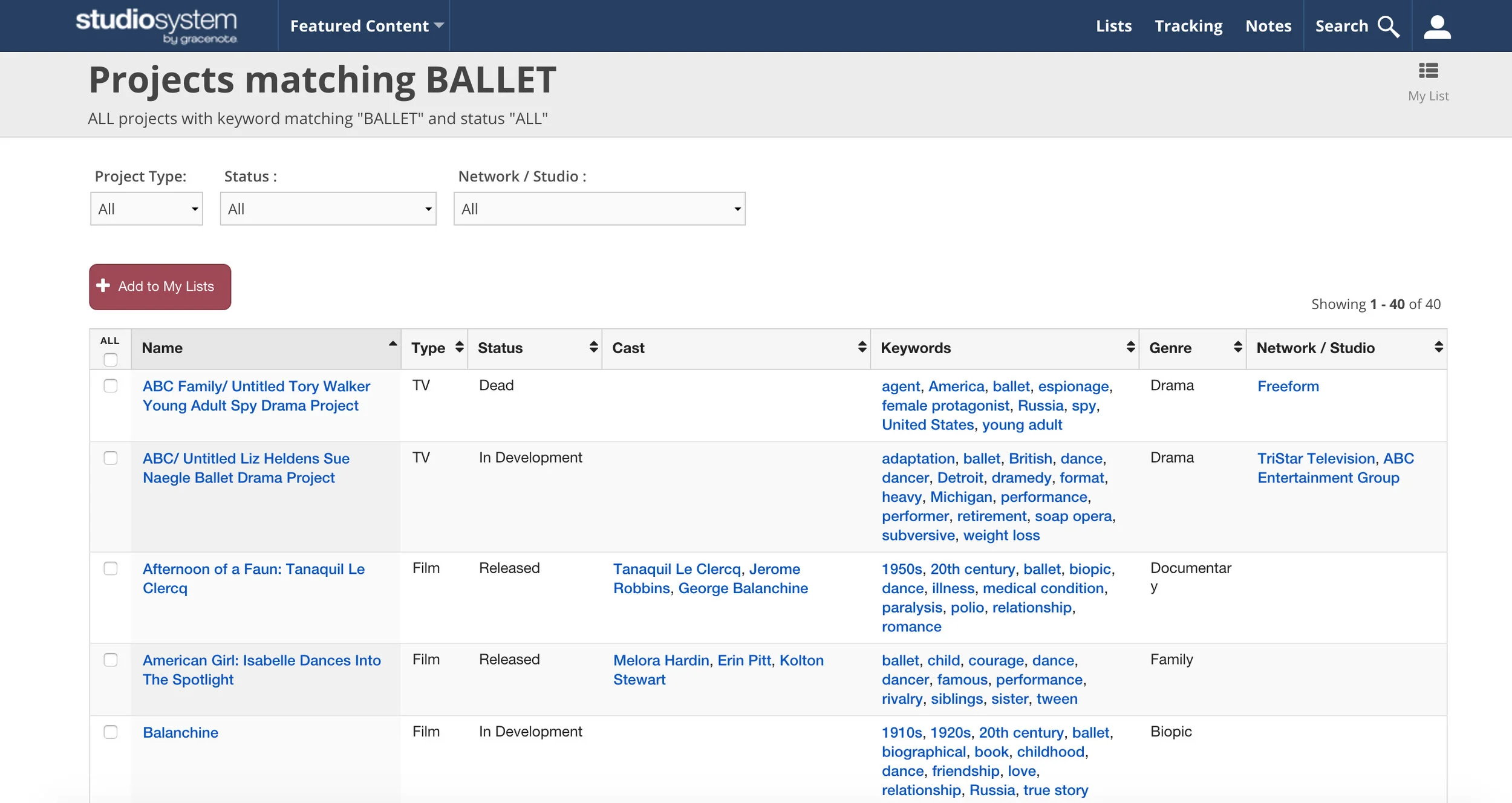

Genre Intelligence

Baseline such as a few other entertainment metadata providers had a proprietary in house list of normalized genres that both film and television projects. This data lived on each project summary but being normalized was not being leveraged on a global scale. By opening up keyword mappings users now have one click access to projects matching hyper focused genres to filter by associated companies, status, or project types. Are you looking for Ballet projects in New York that were previously released, this was the go to tool.

Client Retention

The development mentioned above was all focused around major legacy client retention as well as acquisition of new clients. The entertainment industry is a niche yet powerful market. With a handful of corporate clients driving 80% of the sites active users it's hyper critical to be developing continual value for those clients. During this optimization period we held user retention across the board at 97% with year over year exponential client growth at a rate of 20%.